Dependent calculator for paycheck

There are many benefits of using a payroll calculator including the ability to estimate your paycheck in advance. Enter number of dependents other than you or your spouse you will claim on your tax return.

7 Best Payroll Calculators In Canada Canada Buzz

For example if you are single and have a child then you should file as Head of.

. Number of Child and dependent care credits to claim on state return 11. Form 8962 Premium Tax Credit PTC Form 8880 Credit for Qualified Retirement Savings. It can also be used to help fill steps 3 and 4 of a W-4 form.

125000 for married taxpayers filing. Adjust your W-4 for a bigger refund or paycheck Get Started. You can also use the same tool to calculate hypothetical changes such as withholding more money from each paycheck or increasing your retirement contributions.

Form 2441 Child and Dependent Care Expenses. You can enter your current payroll information and deductions and then compare them to your proposed deductions. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia paycheck calculator.

IRS Federal Taxes Withheld Through Your Paychecks. Guide to Using the Withholding Calculator. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

The Savings Power of This FSA. Earned Income Tax Credit. Number of earned income credits to claim on state return 12.

While this list shows the eligibility of some of the most. Switch to Georgia hourly calculator. Switch to Georgia salary calculator.

This filing status requires a dependent child and allows for the retention of the benefits associated with the Married Filing. Calculating your South Carolina state income tax is similar to the steps we listed on our Federal paycheck calculator. It only takes a few minutes to do however.

You are single and have only one job You are married have only one job and your spouse does not work or Your wages from a second job or your spouses wages or the total of both are 1500 or less. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. Child Dependent Care Credit For 2 dependents up to.

So my suggestion is using a withholding. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. Instead you fill out Steps 2 3 and 4.

To use the calculator youll need certain pieces of documentation. A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or after school programs and child or adult daycareIts a smart simple way to save money while taking care of your loved ones so that you can continue to work. Use this calculator to help you determine the impact of changing your payroll deductions.

Free Federal and New York Paycheck Withholding Calculator. Benefits of Using a Payroll Calculator. If not your South Carolina income tax ranges from.

250000 for married taxpayers filing jointly. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. 2021 2022 Paycheck and W-4 Check Calculator.

Federal Paycheck Calculator Calculate your take home pay after federal state local taxes Updated for 2022 tax year on Aug 02 2022. No state-level income tax if you earn less than 3070 per year. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Your Dependent Care FSA pays for various child and adult care services so you can go to work. Enter 1 for yourself if no one else can claim you as a dependent. Form 8863 Education Credits.

This Georgia hourly paycheck calculator is perfect for those who are paid on an hourly basis. Instead you fill out Steps 2 3 and 4. For a start the calculator will ask for an estimate of your income and your eligibility for the Earned Income Tax Credit and the Child Tax Credit.

What taxes do South Carolinian pay. Tax Calculator 2021 Tax Returns Refunds During 2022. Enter your info to see your take home pay.

Try changing your tax withholding filing status or retirement savings and let the payroll deduction calculator show you. Check if I can claim my spouse as a dependent 3. 200000 for single filers heads of household and qualifying widowers with dependent children.

The IRS determines which expenses can be reimbursed by an FSA. The Dependents Credits Deductions Calculator is free to use and lets you know what dependents credits and deductions youre eligible to claim on your tax return. Free Federal and Illinois Paycheck Withholding Calculator.

The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you. You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services. Your marital status and whether you have any dependent will determine your filing status.

Figure out your filing status. Now you can easily create a Form W-4 that reflects your planned tax withholding amount.

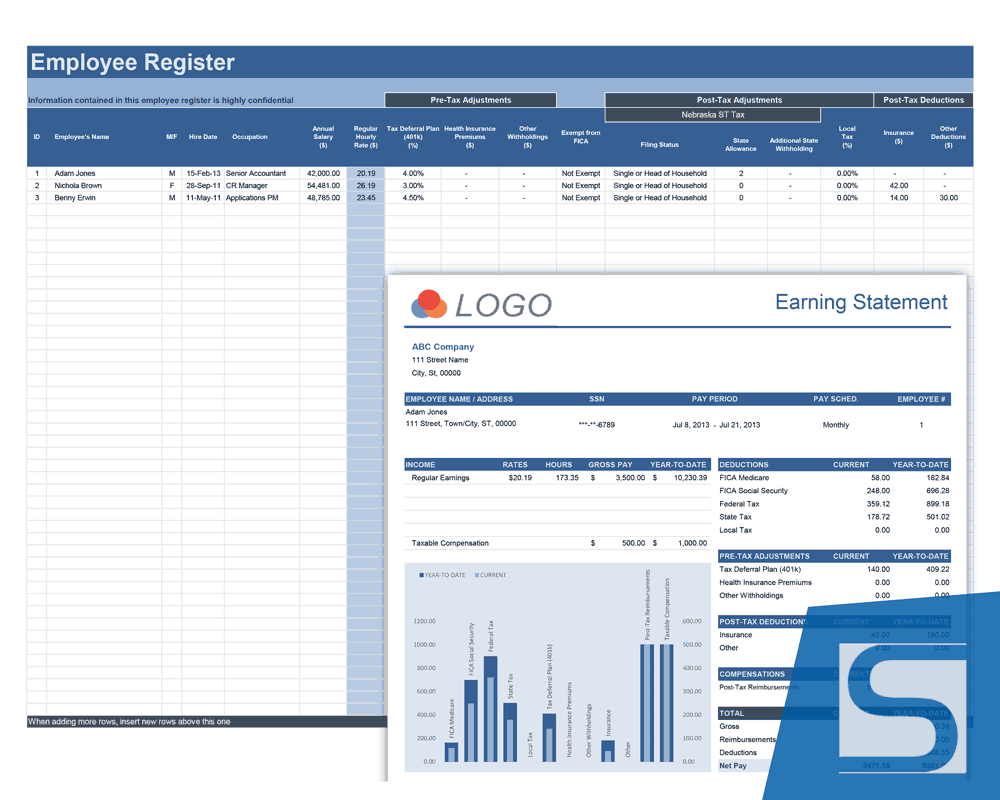

Payroll Calculator Free Employee Payroll Template For Excel

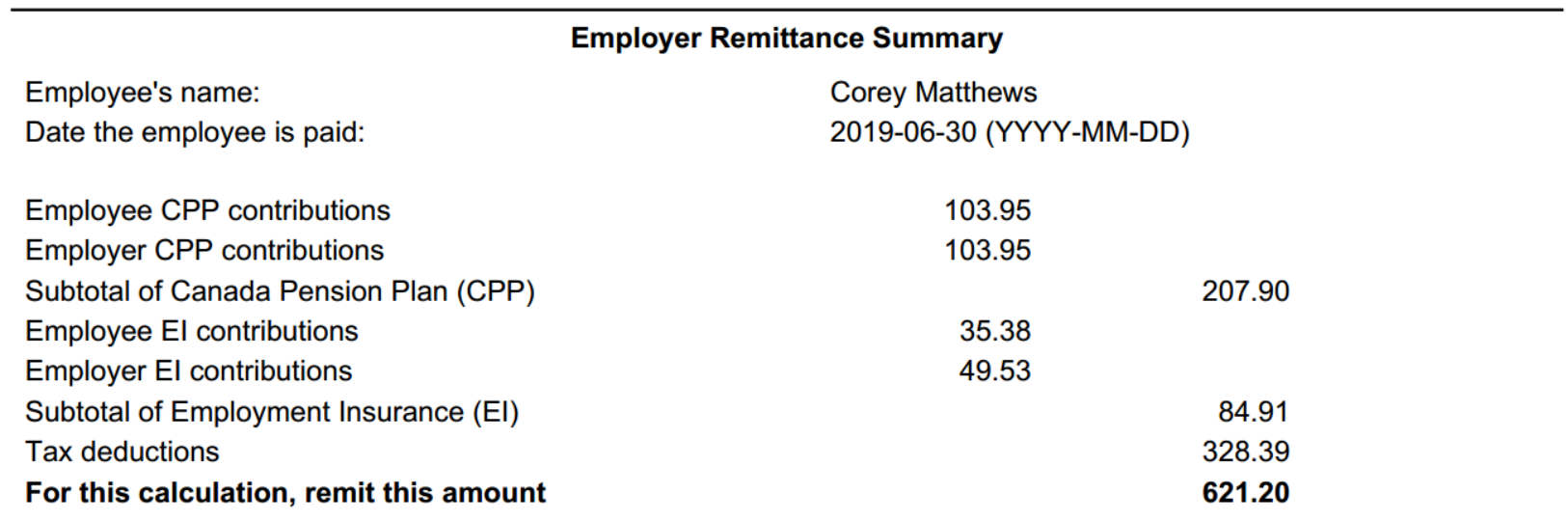

Your Easy Guide To Payroll Deductions Quickbooks Canada

Tax On Wages Calculator Clearance 55 Off Www Ingeniovirtual Com

Tax Payroll Calculator Outlet 67 Off Www Oldtrianglecharlottetown Com

Payroll Calculator With Pay Stubs For Excel

Baby Growth Chart Templates 11 Free Docs Xlsx Pdf Baby Growth Chart Baby Growth Growth Chart

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Excel Good Essay

Avanti Gross Salary Calculator

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Deductions Calculator Online 60 Off Www Ingeniovirtual Com

Mortgage Calculator Mortgage Calculator From Bankrate Com Calculate Payments Wit Mortgage Loan Calculator Mortgage Calculator Mortgage Amortization Calculator

Payroll Calculator Free Employee Payroll Template For Excel

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Loan Calculator Templates 7 Free Docs Xlsx Pdf Loan Calculator Loan Templates

Avanti Income Tax Calculator

How To Calculate Taxable Income H R Block